Timing is everything

Profitability and cash flow are two very different things. Many businesses can be profitable and still struggle due to limited or negative cash flow. An extremely important part of controlling cash flow is managing the timing of when you receive your payments. It’s easy to minimize the impact, but one of the biggest factors influencing cash flow is your accounts receivable. Other business priorities are competing for your attention, and managing your accounts receivable can be a time-consuming undertaking.

Turnover ratio

When trying to improve your accounts receivable management, it’s helpful to know where you stand. A simple way to measure this is to calculate your accounts receivable turnover ratio. As per MyAccountingCourses.com, “Accounts receivable turnover is an efficiency ratio or activity ratio that measures how many times a business can turn its accounts receivable into cash during a period. In other words, the accounts receivable turnover ratio measures how many times a business can collect its average accounts receivable during the year.

“A turn refers to each time a company collects its average receivables. If a company had $20,000 of average receivables during the year and collected $40,000 of receivables during the year, the company would have turned its accounts receivable twice because it collected twice the amount of average receivables.”

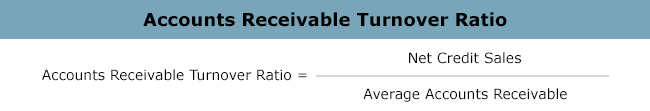

The formula

Accounts receivable turnover is calculated by dividing net credit sales by the average accounts receivable for that period. Although this is a general formula, it provides a good indication of accounts receivable performance. Insurance brokerages may wish to tweak the formula slightly to remove any third-party-financed amounts from an accounts receivable balance to show only the turns on the A/R balance due from clients. Each business should set its own target ratio, but, on average, if you want to ensure you’re paid within 90 days, you need a target of at least four. If your goal is to be paid within 60 days, you’ll need a target around six.

A/R management

Conceptually, we know we want to receive payments as quickly as possible. Better accounts receivable management reduces your time on risk and helps ensure compliance with regulatory associations. There are conventional methods like monitoring your receivables balance, running aged receivable reports and following up with clients when accounts are past due. The drawback to these processes is that they’re reactive approaches and require diligent monitoring. If payment issues do arise they can cause conflict, straining the relationship.

Getting paid on time

You can do more than just manage the accounts receivable after the sale. The process begins before a potential client finalizes business. Proactively providing payment options to clients can ensure speedy payments Accepting credit cards provides an alternative payment method to clients apart from cash or cheques. More and more clients prefer the convenience, having all expenses on one statement or the opportunity to collect loyalty points. This means you can be confident the payment is verified, and it eliminates the cost and administration associated with collection, NSFs on returned cheques and followup with the client. Credit card payments are also typically deposited in an account the next business day.

Another method of securing faster payments can be to offer clients the convenience of direct bill or premium financing. These alternatives enhance your value proposition and proactively minimize receivables. Even though your business may provide these options, there can still be inconsistencies among your various business units or producers in following through when presenting these options to each and every client. The premise here is that you need to build enough volume to positively impact cash flow. A simple way to ensure success is to automate the premium financing presentment process. Automation establishes consistent presentment for all your clients and takes the effort out of your employees’ hands during and after the sale.

Your receivables and cash flow can perform better with a refinement in their processes. You may already be doing some or all of the post-sale tactics, but your success is bolstered with a two-pronged approach, which includes before and after the sale. Prosperous cash flow and accounts receivable management are similar to almost all opportunities: timing is everything.